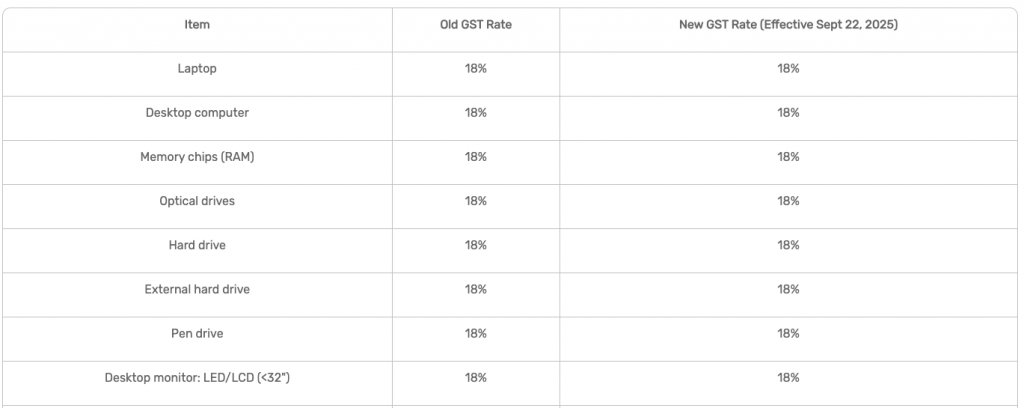

India has just overhauled its Goods and Services Tax (GST) system. From late September 2025, there will be only two slabs—5% and 18%—and rates on hundreds of consumer goods, from televisions to air conditioners, have been reduced. The aim is clear: to boost domestic demand and make essential tech more accessible.

But for anyone in the market for a graphics card, the picture remains bleak. GPUs are still taxed at 18%, and their prices in India continue to sit far above global levels.

So why does a piece of hardware that costs $1,999 in the US (the launch price of NVIDIA’s RTX 5090) often end up retailing for 30–40% more in India? The answer lies in the layers between silicon and shelf.

Taxes Aren’t the Whole Story

GST accounts for a clear chunk of the price difference, but it’s not the main driver. Unlike some other electronics, GPUs don’t attract additional customs duties. Yet the 18% GST still adds a heavy premium to already expensive hardware. The recent reforms, while broad in scope, leave GPUs untouched.

Supply Chains, Freight, and Market Scale

Every GPU shipped to India carries the weight of logistics. Smaller shipment volumes mean higher costs per unit, and air-freighting during shortages drives the price up even further. Insurance, warehousing, and distribution fees stack on top, long before the card reaches a retailer’s shelf.

In larger markets, distributors can offset those costs through scale. In India, the enthusiast GPU market is relatively niche, so those expenses land squarely on each unit sold.

Distributor and Retail Markups

Margins are where the gap truly widens. Distributors and retailers in India often prioritise profit per unit rather than volume sales. That scarcity premium pushes prices up well beyond what GST or freight can explain. Even mid-tier cards, like the RTX 5070 Ti, see inflated tags that push them out of reach for many.

Currency and Global Pricing Pressures

Add to that the rupee’s vulnerability against the US dollar and recent global price hikes—NVIDIA raised prices on RTX 50-series GPUs by up to 15% this year—and the base cost keeps climbing. Indian buyers end up paying not only for global shortages but also for hedges against currency fluctuations.

The AI/ML Cost Barrier

High GPU prices don’t just frustrate gamers or creative studios. They directly affect India’s ability to compete in artificial intelligence and machine learning.

- Startups must spend disproportionately more to build GPU clusters.

- Universities struggle to provide students with access to modern compute power.

- Independent researchers often fall back on limited cloud credits, which carry ongoing operational costs.

The result is a slower pace of local innovation. While the GST reforms may stimulate consumer markets, they do little to ease the cost of the hardware most essential for AI development.

Closing the Gap

Until GPUs move into a lower tax slab—or until distribution practices change—prices will remain steep in India. But that doesn’t mean businesses, researchers, and creators are without options.

At The MVP, we work to narrow the gap by:

- sourcing directly to reduce channel markups,

- advising clients on performance-per-rupee setups (where, for example, multiple RTX 5070 Ti cards might offer better value than a single flagship), and

- ensuring that AI builders, studios, and enterprises get fair access to the compute they need.

High GPU prices are a structural issue. But access to compute shouldn’t be the factor that keeps India from advancing in AI.

Leave a Reply